March 2017

President’s Newsletter

A Brief History of PEMC

Pacific Empire Minerals Corp. was incorporated on July 13, 2012 under the Business Corporations Act of British Columbia. PEMC’s core business strategy has been to focus on goldrich copper porphyry opportunities in British Columbia. The Company utilizes the Prospect Generator business model and believes this strategy provides investors with the greatest exposure to discovery while reducing the inherent risk associated with early stage mineral exploration. In June of 2012, PEMC staked the Later 1-12 claims in north-central British Columbia. This was followed by the signing of an option agreement for the Col property in March of 2013. When combined, this roughly 24,000 hectare land position was PEMC’s first significant land position and flagship property. Almost immediately, the price of gold and copper dropped significantly. In early 2013, the price of copper was in the $3.60/lb range and by June of that year the price of copper had dropped to $3.00/lb. Similarly, in early 2013 gold was trading around the $1600/oz level and by mid-summer of 2013 it had dropped to just over $1200/oz. Over the next three years the price of copper and gold continued to decline with gold reaching levels below $1100/oz in December of 2015 and copper dropping below $2.00/lb in early 2016. During this time PEMC remained focused and continued to acquire high quality projects at a low cost.

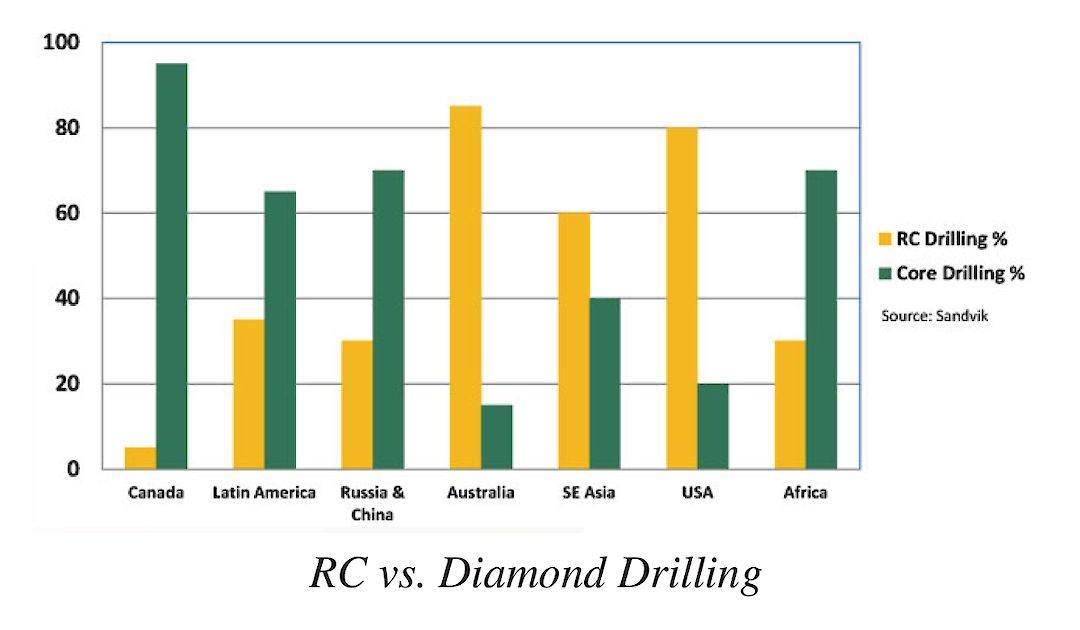

5 Year Spot Copper Price (lb) 5 Year Spot Gold Price (Oz) In early 2016, the price of copper and gold began to reverse course. Over the last 16 months the price of gold has increased from $1100/oz to $1250/oz and the price of copper has increased from $2.00/lb to $2.60/lb. This increase in base and precious metals prices has been reflected in investment and exploration activity. With an attractive portfolio of copper-gold assets PEMC is in a position to take advantage of increased commodity prices. A critical component of any prospect generator is the ability to develop partnerships with larger companies that have the ability to advance projects with diamond drilling. PEMC was successful in attracting Oz Minerals ("Oz") as a partner to advance the Col-Later project in 2014 and 2015 and more recently ML Gold Corp. ("ML Gold") to continue exploration during 2016 and 2017. Equally important for a company that utilizes the prospect generator model is the ability to generate multiple ongoing partnerships and to secure attractive deal terms. Over the last four years PEMC has been fortunate to develop relationships with numerous major mining companies that are actively looking for copper and gold projects in British Columbia. Based on feedback from these companies PEMC determined that in order to have multiple ongoing partnerships, and to secure attractive terms for PEMC, drilling is critical. Traditionally the vast majority of drilling in Canada has been diamond drilling rather than Reverse Circulation ("RC") drilling. A primary reason for this is that historically RC drill rigs have been large, heavy truck mounted machines. Such machines are not well suited for exploration work in British Columbia due to the challenges and associated costs of moving the drills.

RC vs. Diamond Drilling

In recent years, smaller, compact, RC drills have been developed specifically for drilling in remote and challenging areas. These compact drills can be track mounted and are ideal for early stage exploration. The advantages of RC versus diamond drilling for early stage exploration are significant. The high cost of diamond drilling often makes this option prohibitive for prospect generators. RC drilling by comparison has a much higher rate of penetration, is far less expensive and because no water or drill pads are required, has several environmental advantages. The ability to rapidly and cost effectively generate high quality drill targets for potential partners will set PEMC apart from its peers and allow the Company to take advantage of the opportunity that exists where overburden obscures bedrock and, as a result, little or no exploration has taken place.

Exploration Update: Later Project

During 2014, Oz completed four Induced Polarization ("IP") surveys on the Col-Later property and two diamond drill holes. During 2015, Oz completed a six-hole diamond drilling program that was highlighted by the intersection of 94 m grading 0.34 g/t gold in DD15ELB001. Following this Oz elected not to continue with the option agreement and the property was returned to PEMC. Based on the results from the 2014 and 2015 exploration programs on the Col and Later properties, PEMC elected to terminate the underlying option agreement with Nation River Resources and Indata Resources for the Col property. In July of 2016, PEMC signed an option agreement with ML Gold whereby ML Gold has the right to earn a 70% interest in the Later property.

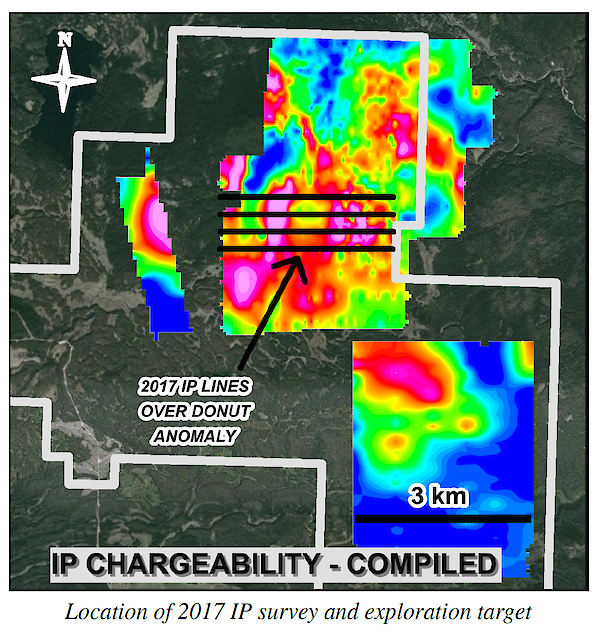

Location of 2017 IP survey and exploration target

Following a diamond drilling program in the fall of 2016, PEMC’s partner ML Gold purchased historical IP data that was competed by BP Resources Canada in 1991. This dataset was never publicly filed for assessment purposes. When combined with additional publicly available IP data and IP data collected by PEMC and partner Oz Minerals during 2014 the size of the anomaly and resulting targeting changed significantly. This was immediately followed up with the acquisition of all remaining inlier claims on the property. A follow-up IP survey over the central portion of the chargeability anomaly is currently underway and additional diamond drilling, based on the results from the current IP survey, is anticipated for 2017.

Wildcat Project

On February 27, 2017, PEMC signed an option agreement to acquire a 100% interest in the Wildcat property located 10 km to the southwest of the currently producing Mt. Milligan Copper-Gold Mine. The property has been the focus of numerous exploration programs consisting of geochemical and geophysical surveys, in addition to diamond and percussion drilling. Drilling in 2011 encountered hydrothermal alteration assemblages typical of those found distal to a copper-gold porphyry system. Drill hole WC11-08 intersected 26.1 m grading 0.14% copper while WC11-07 intersected 0.7 m grading 1.34% copper and 0.626 g/t gold. All necessary permits to conduct ground based geophysical surveys have been received and following completion of the IP survey at the Later property a reconnaissance IP survey is scheduled to commence in mid-April. Based on the results of this survey a reverse circulation drill program may be conducted during 2017 to test any targets of merit.

Copper Star Project

In January 2017, PEMC acquired a 50% interest in the Copper Star Project, located 42 km west-southwest of the town of Houston in Central British Columbia. In 1998, Imperial Metals completed a program of 43 short (3-15 m) percussion holes and rock sampling. Drilling was successful in intersecting up to 0.49% copper. The following year, Misty Mountain (Hunter Dickinson Group) completed 67 line-km of IP surveys and collected 817 soil samples. Results from this program outlined five IP anomalies in addition to a broad distribution of copper mineralization. In 2001, Doublestar Resources completed 1581.53 m of diamond drilling in nine holes. Significant results from this program included 142.3 m @ 0.25% Cu from hole CS-07 and CS-02 which returned 97.5 metres grading 0.08% copper with the hole bottoming in 0.56% copper. All of the remaining holes intersected anomalous copper mineralization. Following digitization of historical IP, drilling, and rock and soil geochemical data, several exploration targets have been identified for further work. The objective of the 2017 exploration season is to test these target areas with RC drilling.